Risks & risk management

Managing our risks

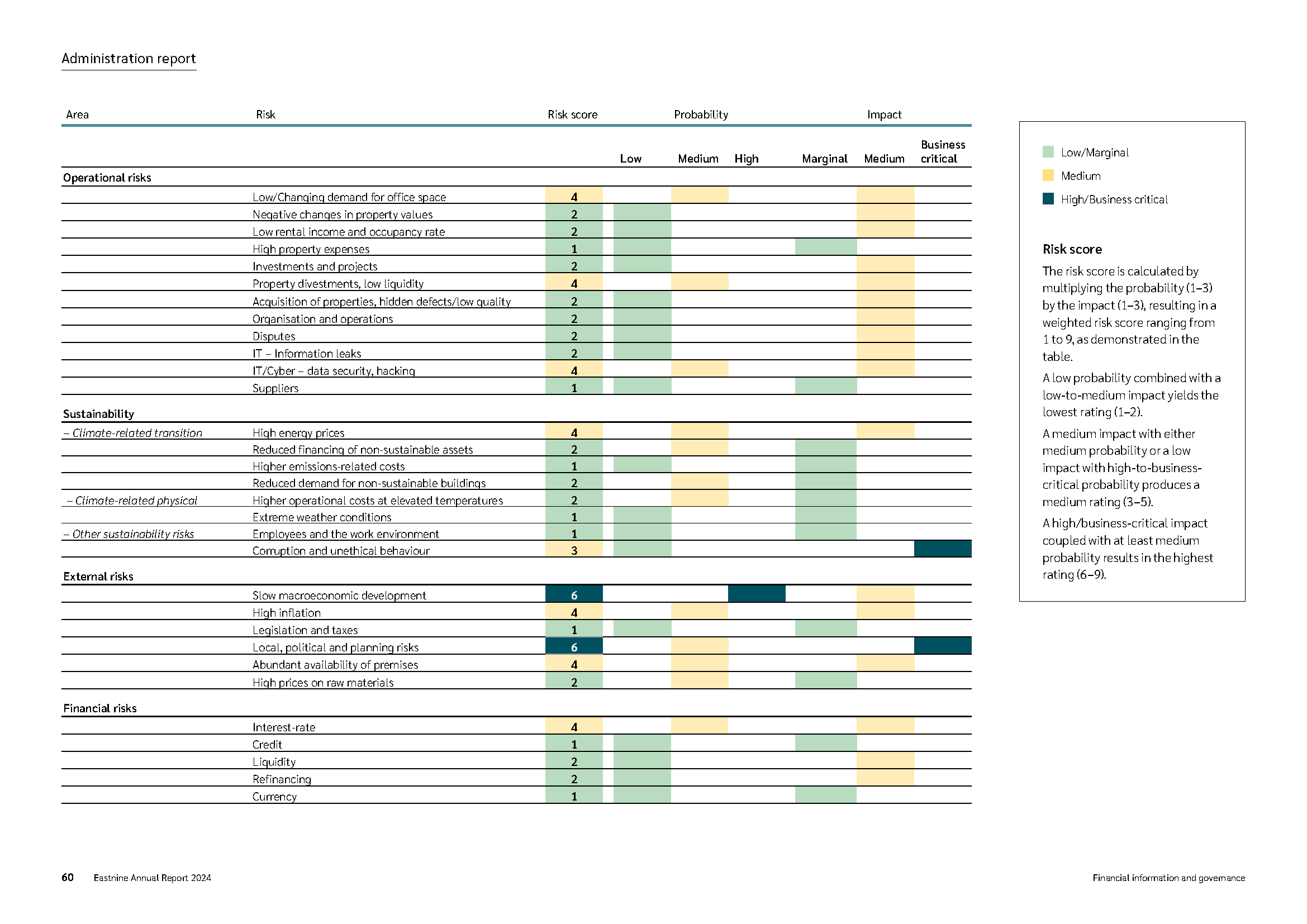

In its activities, Eastnine is exposed to various kinds of risk. Our risks at group level are subdivided into operational risks, sustainability risks, external risks, and financial risks.

Risk management is handled by the Company’s management in accordance with relevant policies that have been established by the Board.

Financial and operational risks

Eastnine manages its own capital for the purpose of achieving the Company’s financial targets and ultimately the overarching goal of return to the shareholders. Financial governance and capital structure are regulated by the Company’s financial policy, which ultimate aim is to achieve balanced and low financial expenses considering the inherent risks of the chosen strategy.

With an investment strategy focused on acquiring modern and sustainable office properties in prime locations in Poland and the Baltics, and the financing strategy for this purpose, the Company is exposed to risks, such as interest-rate, credit, rental and vacancy risks.

Eastnine monitors the development on the property and office markets as well as of the demand from tenants relating to the design of office space, in order to be able to customise office premises according to needs and wishes. The risk of negative value changes is primarily handled by offering modern and attractive office premises in the best locations, and thereby attracting and retaining stable tenants, which reduces the risk of vacancies and rent reduction levels.

Eastnine’s lettings are, first and foremost, agreed on as triple-net agreements, meaning that tenants are liable to pay costs relating to their premises. Eastnine’s high surplus ratio is attributable to the fact that a majority of Eastnine’s leases are triple-net, which reduces the effect of rising property expenses, while increased vacancies may increase property expenses for Eastnine.

Sustainability risks

Eastnine's goal is to achieve climate neutral property operation at the latest by 2030. Energy efficiency improvements, a higher share of renewable energy and local production of renewable energy are our foremost strategies for limiting risk. Eastnine carries out a systematic analysis of local, physical climate-related risks in the property portfolio.

Eastnine works systematically with corporate culture and values, focusing on ethical operations and zero toleration for corruption and nepotism. Training on anti-corruption and business ethics takes place at least once a year where all employees discuss and analyse hypothetical cases where problems may arise. Observations or suspicions of unethical behaviour can be reported anonymously to a whistleblower function on Eastnine’s website. Sustainability inspection of all strategic suppliers is carried out.

A detailed description of Eastnine's risks

Click the image to see a probability and impact matrix of all identified risks.

Eastnine's risks and risk management are described in more detail in the Annual Report on pages 59-66 and in note 27 on pages 92-93, as well as the latest interim report.

Download the risk document for a more detailed description of the risks.