Investment arguments

Investing in Eastnine’s shares confers a stake in a Swedish listed real estate company focusing on high-yielding, modern and sustainable office properties in Poland and the Baltics. Eastnine combines Swedish corporate governance with local property management and market knowledge.

Long-term trends

- Well positioned to monetize on the upside of long-term trends.

- Operates in Europe’s fastest-growing markets over the past 25 years. Markets that are expected to continue outperforming the growth of most other European countries also in the future.

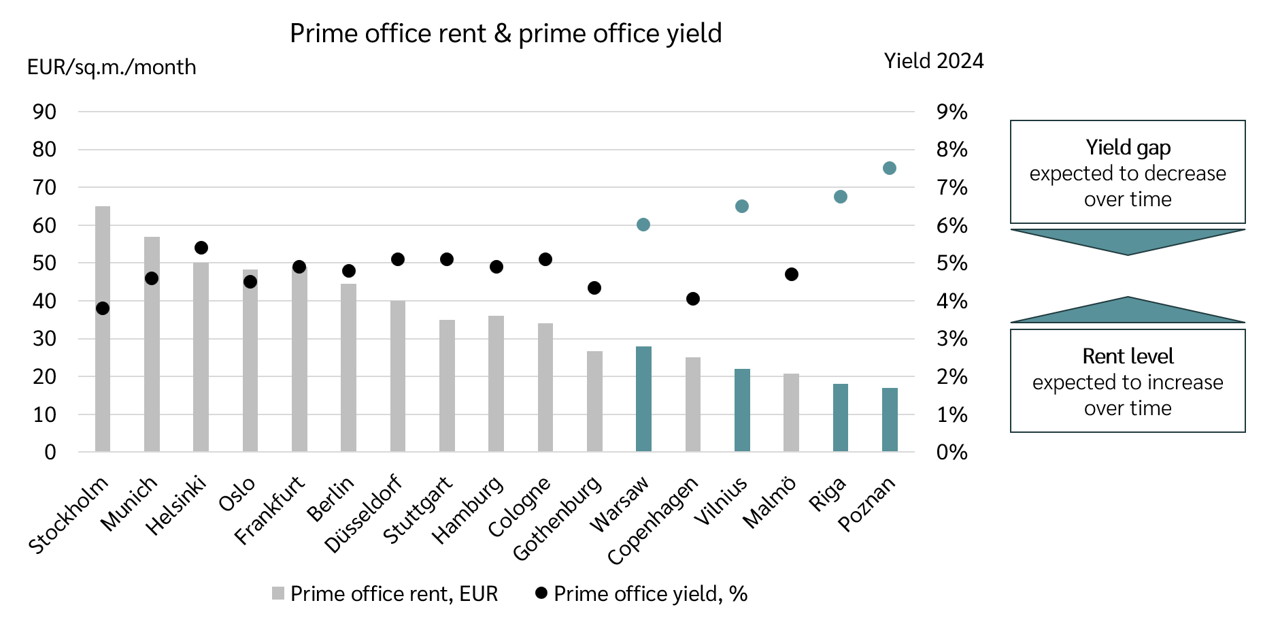

- Differences in yield and rent levels in relation to comparable markets are expected to decrease over time, providing long-term value-appreciation potential.

Image

Premium properties in prime locations

- Strict focus on premium and sustainable office properties in attractive locations with excellent infrastructure.

- Long-term owner with buy-and-hold perspective, seeking strong positions in each market.

- Strong and diversified tenant base and long-term relationships.

- Modern properties with low maintenance needs.

High-yield

- Operates in markets with relatively higher property yields and comparable financing costs, creating robust cash flow and favourable conditions for continued value-appreciation.

Image